Risk management and internal control

Main risks |

Risk factors |

Mitigants |

|---|---|---|

Exogenous Risks associated with shifts in external factors such as economic, political or legislative change |

|

|

Strategy Risks resulting from the definition, implementation and continuation of the group’s guidelines and strategic developments |

|

|

Cash and cash equivalents, financial instruments and financing Risks associated with the management of cash and cash equivalents, financial instruments and financing |

|

|

Operations Risks resulting from inadequacies or failures in internal procedures, staff management or systems in place. Risk of non-compliance with quality standards, contractual and legal provisions and ethical norms |

|

|

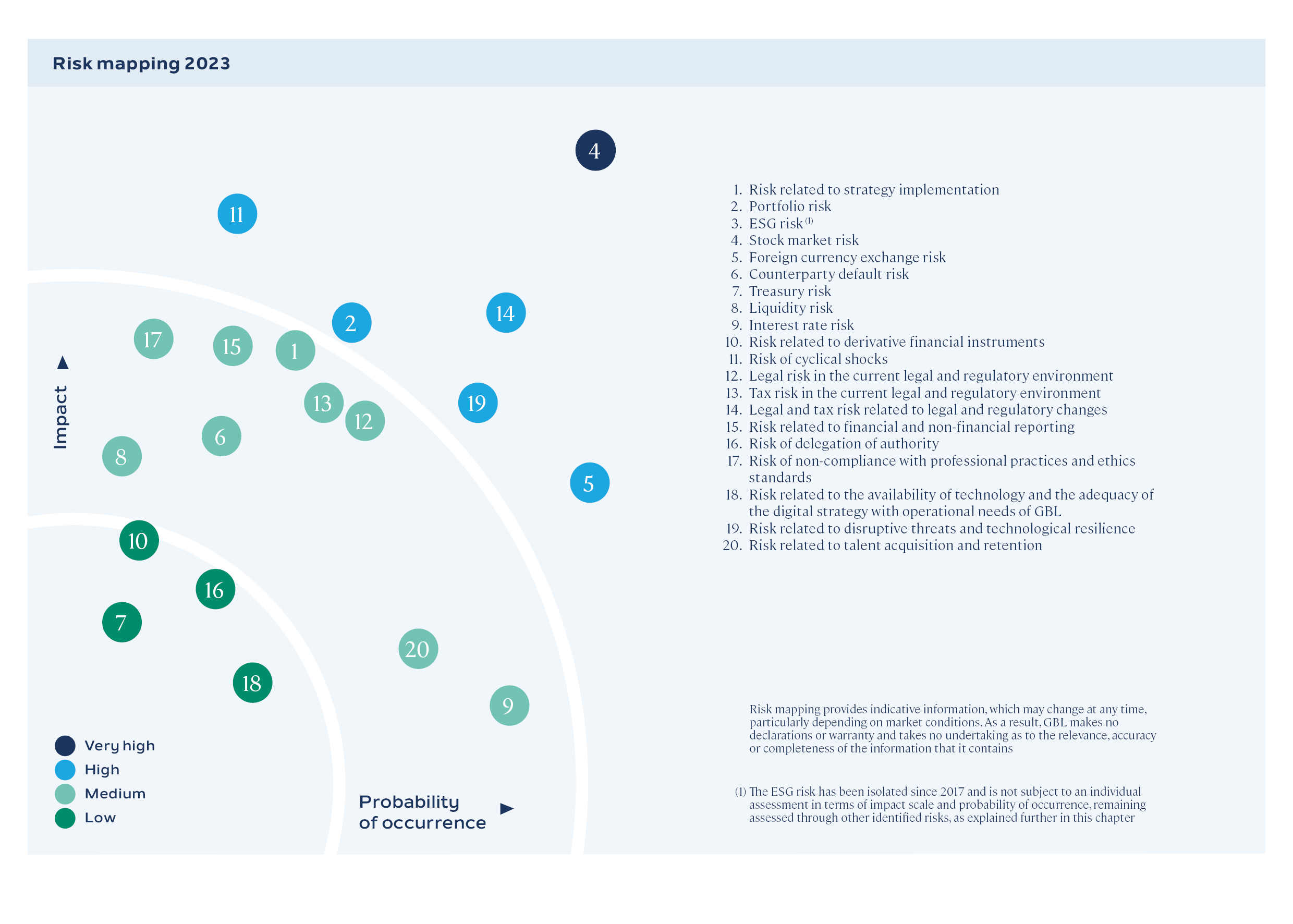

Risk mapping 2023

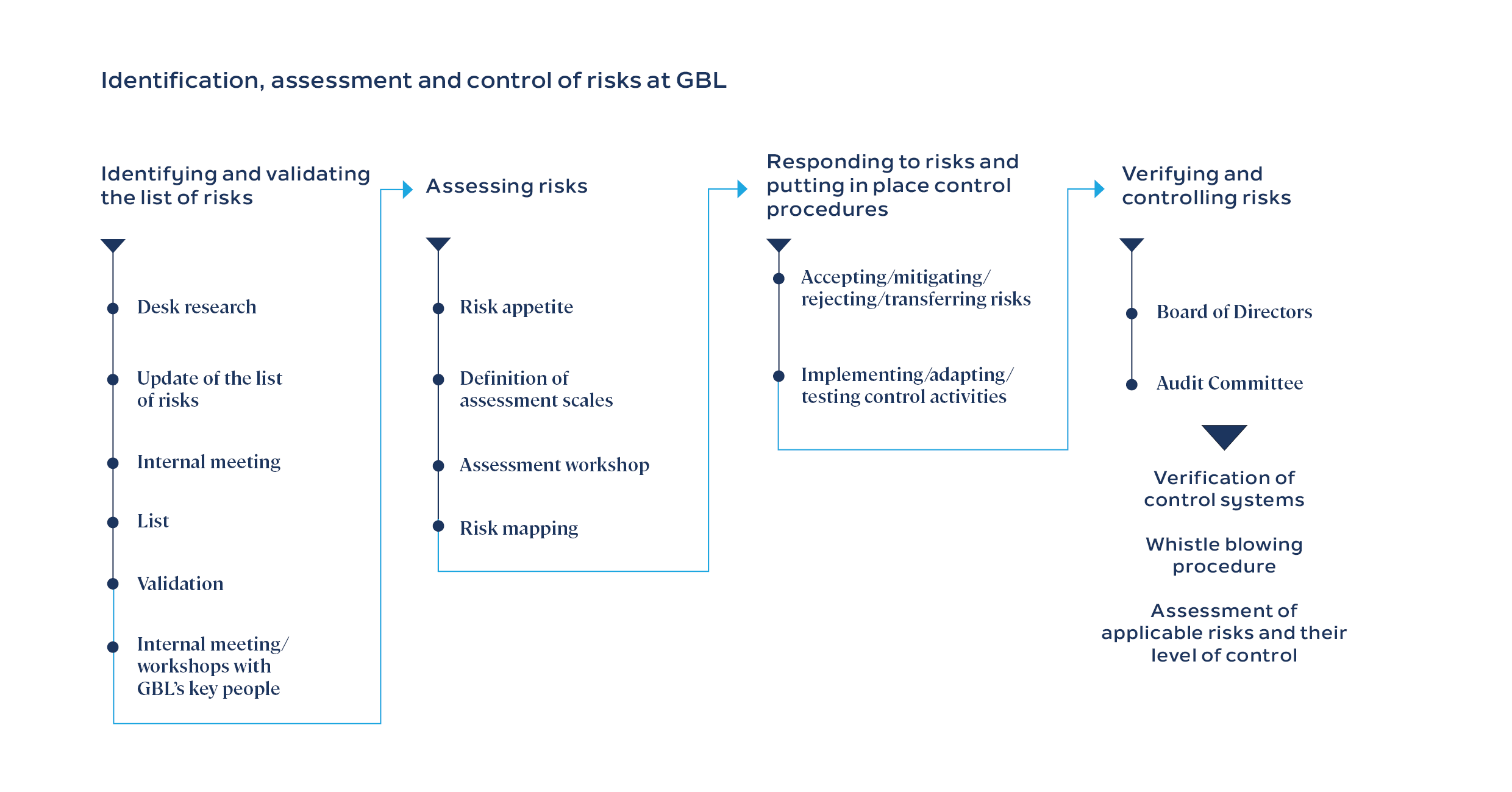

Identification, assessment and control of risks at GBL

Specific risks related to the participations

The bulk (82%) of GBL’s portfolio at year-end 2023 is composed of 12 participations which are exposed to specific risks related to their activities, risks to which GBL is indirectly exposed. The possible materialisation of these risks can indeed lead to a change in the overall value of GBL’s portfolio, its distribution capacity or its results profile. GBL is also exposed to risks related to its investments carried out through GBL Capital and Sienna Investment Managers which account for 18% of the portfolio value as of December 31, 2023.

Each of the portfolio companies carries out its own analysis of its risk environment. The specific risks related to them are identified and addressed by the companies themselves within the framework of its own internal control and risk management. The works carried out by these companies on risk identification and internal control are described in reference documents on their websites.

Access to adidas website

Access to Affidea website

Access to Canyon website

Access to Concentrix + Webhelp website

Access to Imerys website

Access to Ontex website

Access to Parques Reunidos website

Access to Pernod Ricard website

Access to Sanoptis website

Access to Sienna Investment Managers website

Access to SGS website

Access to Umicore website

Access to Voodoo website