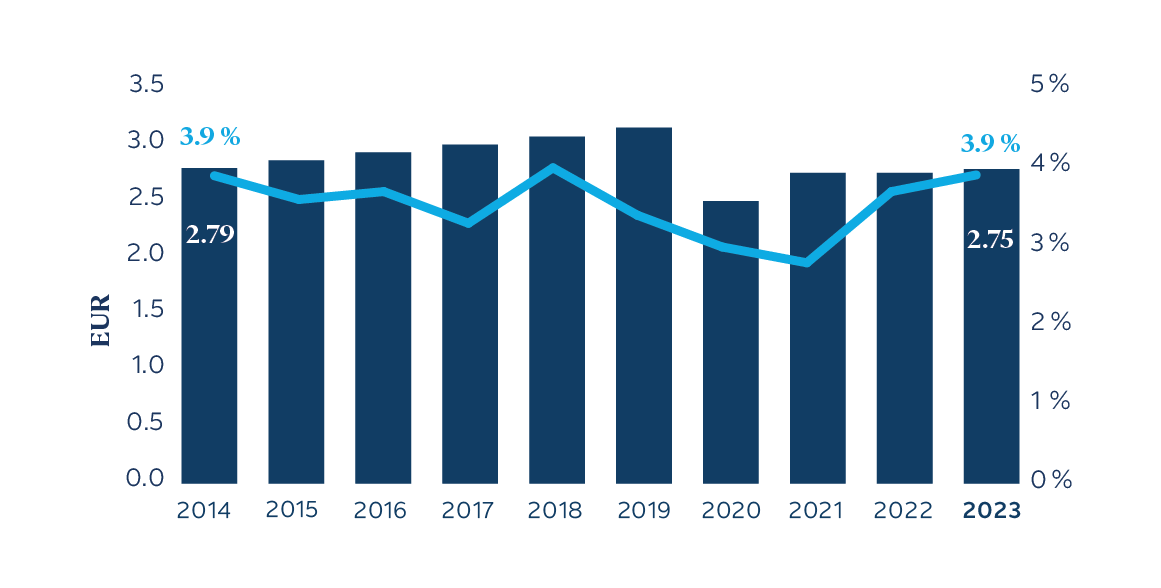

Profit distribution and proposed dividend

The profit allocation related to the 2023 financial year will be submitted for approval to the Ordinary General Meeting on May 2, 2024, for a total of EUR 380.5 million, compared to EUR 402.4 million granted for the previous year.

Taking into account the number of GBL shares entitled to dividends, this proposal for the distribution of profits corresponds to a gross dividend of EUR 2.75 per share (stable compared to the dividend for 2022), equivalent to EUR 1.925 net per share.

Evolution of the gross dividend per share over the last 10 years

(in euro)

- Gross dividend

- Dividend yield

Gross dividend per share: EUR 2.75 (stable)

Total amount: EUR 380.5 million

Coupon n°26

Ex-dividend date

Record date of the positions eligible

Payment date